Novartis is one of the biggest pharma businesses on earth. I've written some about it on the free side, but I haven't yet done a premium deep review.

In this article, we'll deconstruct Novartis to a detailed level and look both at the upside and downsides to the company. I successfully rotated some of my good returns in pharma, including AbbVie into Novartis, and I've not regretted the partial reallocation one bit.

Let me show you why.

Novartis - A review

Novartis is a Swiss multinational pharma business, and with its revenues of $50B, a market cap of 180 billion Swiss francs, and 110,000 employees, it's one of the largest in the entire world.

The company is a merger of the two companies Ciba-Geigy and Sandoz, both of which have their own long histories. During the merger, several sub-segments of the two operations were sold or spun off, like Ciba Specialty Chemicals. Sandoz didn't exist after the merger until 2003 when it was revived as the generics brand for Novartis. The company has also since then divested its Agrochem business, similar to AstraZeneca, and therefore today only works with pharmaceuticals.

In terms of sales, Novartis is the third-largest pharma business on earth. This is behind Pfizer and Roche. From a high level, we can say that Novartis is involved in the R&D and effective commercialization of drugs for various therapeutic areas.

The company divides its operations into two areas:

-

_Innovative Medicines - specialized, patent-protected drugs

_Sandoz - Generics/Biosimilars

They are then further split into a variety of sub-segments, usually related to specific treatment areas.

Novartis is the second-largest company in Oncology on earth, behind Roche, and is also the second-largest generic company, behind Teva. The company has a concentrated focus on all things pharma and does not have any other relevant operations.

The company's asset base, both in terms of production and research, is concentrated in legacy areas. By that, I mean that 97% of all of the company's non-current assets are either in Europe or the USA, with 43% of assets in Switzerland alone. Novartis is not a company to outsource either production or research to cheaper areas, such as Asia or Africa - at least not yet. That isn't the same as the company not having China sales - which it does through Sandoz, where it's the largest supplier to the entire Chinese state. However, I view it as likely that Novartis will revisit its Chinese dependence given the current trade trends between west and Asia.

Novartis doesn't have as concentrated a manufacturing base as any of its peers. Compared to Roche, Novartis has 5X as many manufacturing sites, due to a well-spread generics business. While there is a planned reduction here, the company will likely retain a somewhat more spread-out asset base.

While I also focused on Sandoz, it's important to point out that the company's revenues are barely 20% Sandoz, and 80% Pharma/Innovative medicines. So Sandoz isn't as important as some might think. Novartis has denied that they're looking to spin off all of Sandoz, but recently failed to sell part of Sandoz assets to an Indian peer. Only 8% of the company's divisional EBIT is from Sandoz, due to increased pricing pressure in the generics segment. This is also part of the reason Novartis may be looking to do something else with Sandoz.

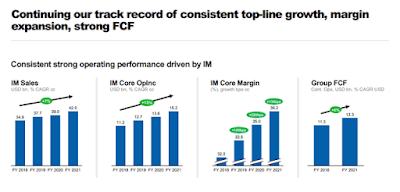

Novartis has extremely strong trends.

The company targets, and expects to be able to grow sales at a 4% CAGR until 2026, in addition to small bumps to the dividend. In 2021, the company saw excellent sales overall, and good sales growth despite the COVID-19 pandemic.

What sets Novartis apart from other pharma companies, as I see it, is its lack of reliance on single blockbuster drugs. While its main drugs do see blockbuster sales, the company has the world's second-largest portfolio pipeline after AstraZeneca. Its portfolio lacks the exposure we see in some, and certainly the risk concentration of some peers like AbbVie and Humira.

Next to Roche, I would consider Novartis one of the best-diversified pharmas out there - with both plenty of legacy brand appeal, and also good pipeline appeal across a variety of sectors.

Más